Columbus Uses Property Tax Abatement to Drive Workforce Housing Development

Jamie Beier Grant

The Montrose Group LLC

The city of Columbus offers discretionary real property tax abatements to incentivize residential developments in targeted communities. Columbus offers a 100% real property tax abatement on the growth in property tax for 100% of the tax for 15 years in areas recognized as a Pre-1994 CRA.[i] Real property tax abatements operate in these areas as a matter of legal right and do not require action by Columbus City Council. All of Downtown Columbus is located in a 1994 Pre-CRA district as are several other areas such as the Southside of Columbus that are primed for residential development.

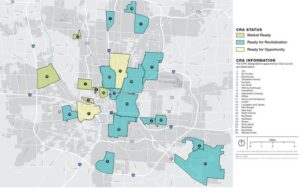

Recently, the City of Columbus has updated its requirements for post-1994 CRA tax exemptions for developers granted permits after September 1, 2023.[ii] Adopted in 2018, the Columbus CRA residential abatement policy is a tool the city can use to encourage developers to create space for everyone in Columbus’ neighborhoods, and the 2018 policy designates specific geographies within the city as reinvestment areas, based on six distress criteria (population growth, median household income growth, poverty rate, growth in median rent, housing vacancy rate, mortgage foreclosure rate):

- Market Ready areas meet 1-2 distress criteria;

- Ready for Revitalization areas meet 2-4 distress criteria; and

- Ready for Opportunity areas meet 5-6 distress [iii]

Within these areas, housing developers are eligible for tax abatement if they set aside a percentage of a development’s units for residents that meet certain income criteria.[iv] The U.S. Department of Housing and Urban Development (HUD) defines and calculates Area Median Income (AMI) for every region of the country, and at 100% AMI, half of the families earn more than the median, and half earn less than the median.[v] The CRA policy creates affordable units in Columbus by offering tax abatements to developers that set aside a certain number of housing units for individuals who earn the median income or less.[vi] Income-qualified tenants are not charged market-rate rent, but rather, a rent that is aligned with their ability to pay without being rent burdened.[vii] At 100% of AMI it is estimated that an individual earning $57,800 could afford rent and utilities of $1445, 80% of AMI provides an affordable rent of $1174 for an individual earning $46,960, and a rent of $880 for an individual earning $35,220.[viii]

Columbus Post 1994 CRA Housing Incentive Map

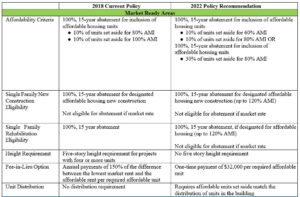

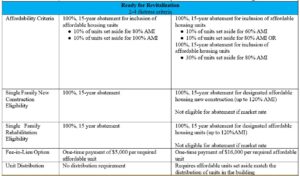

The Columbus Development Department conducted a review of its 2018 CRA residential tax abatement program and has identified opportunities to ask developers to expand the affordability captured for the value of the abatement. Based on an independent analysis of 2021 market conditions, the new Columbus policy asks developers to go deeper or wider in creating affordability, in order to earn an abatement.[i] The policy set in 2018 asked developers to set aside 10% of units for residents earning 80% AMI and 10% for residents earning 100% AMI in order to earn an abatement.[ii] Under the proposed policy, developers could choose to go deeper in creating affordability by setting aside 10% of units for residents earning 60% AMI and 10% for residents earning 80% AMI, or, go wider in creating affordability by setting aside 30% of units for residents earning 80% AMI.[iii] As required by the current policy, developers earning these incentives would be required to report to the city annually to ensure compliance with the policy. Developers that fail to stay in compliance with the policy for the full 15 years are subject to fines and the property may be placed back into taxable status.[iv] This policy change was made in an effort to ensure the development of more affordable housing units.[v] Columbus has also raised the cost to buy out units by 300%. After these changes take effect, developers seeking a CRA tax exemption in market-ready areas could pay a one-time fee of $32,000 per affordable unit; $16,000 per unit in ready-for-revitalization areas; and $5,000 per unit in ready-for-opportunity areas.

Summary of Proposed Columbus Post-1994 CRA Housing Incentives Policy Changes

Please contact Dave Robinson at drobinson@montrosegroupllc.com if you need assistance with any housing or economic development incentive matter.

[i] Ibid.

[ii] Ibid.

[iii] Ibid.

[iv] Ibid.

[v] Ibid.

[i] https://www.columbus.gov/Development/

[ii] Ibid.

[iii] Ibid.

[iv] Ibid.

[v] Ibid.

[vi] Ibid.

[vii] Ibid.

[viii] Ibid.

Dayton selected as host city for the 2026 OEDA Annual Summit

Dayton selected as host city for the 2026 OEDA Annual Summit Ohio’s premier state-level economic development conference will showcase the Dayton region in 2026 Akron, Ohio – Thursday, October 16, 2025 – The Ohio Economic Development Association (OEDA) announced...

OEDA Closes Summit with Inaugural Hall of Honor

OEDA Closes Summit with Inaugural Hall of Honor Dennis Mingyar and Kenny McDonald inducted; members approve 2026 board slate. Akron, Ohio – Friday, October 17, 2025 – The Ohio Economic Development Association (OEDA) concluded the 2025 OEDA Summit today with its...

Record Attendance as 600 Economic Development Leaders Gather in Akron for the 2025 OEDA Summit

For Immediate Release Record Attendance as 600 Economic Development Leaders Gather in Akron for the 2025 OEDA Summit Nation's largest state-level economic development conference marks 45 years of advancing Ohio's growth and collaboration. AKRON, OHIO – Thursday,...