CAR’s Book of Deals Analysis

Terni Fiorelli

Center for Automotive Research

Since the early 2000s, the Center for Automotive Research (CAR) has been tracking publicly announced North American automakers and supplier investment details. This information populates a proprietary database known as The Book of Deals, which is a part of CAR’s Automotive Communites Partnership (ACP). The Book of Deals covers capital investments—such as updating equipment, increasing production capacity at a plant, or building a new facility. The following analysis focuses on automakers that have publicly announced investments in North America from 2009 to 2019.

Historical Trends:

Since the 2009 recession, automakers have announced over $141.0 billion worth of investments in North America. The United States received the largest share of announced investments during this timeframe (76 percent), with Mexico (17 percent), and Canada (6 percent) accounting for less than a quarter share of North American investment combined. The majority of these announcements were allocated to manufacturing facilities, as shown in Table 1 below.

Table 1: N.A. Announced Automaker Investments by Type, 2009 to 2019 YTD

| Number of Announcements | Investment Total (in billions) | |

| ALL Investments* | 586 | $140.0 |

| MFG Only | 463 | $131.6 |

| R&D Only | 55 | $4.5 |

| Admin Only | 37 | $1.2 |

| All Other | 31 | $ 2.7 |

*Note, the investment by type analysis will not equal the total investment for 2009 to 2019 YTD. This discrepancy is because several investments did not disclose enough information and, therefore, are not included in this analysis.

Over the years, the “big dollar” investments in new automotive facilities tend to receive a disportionate amount of media and industry attention. An example of these types of investments include the following:

- In 2014, Tesla announced plans to invest $5.0 billion into a battery “gigafactory” in Reno, Nevada. This investment generated $1.25 billion in incentives and was projected to create 6,500 jobs.

- In 2012, Nissan announced plans to build a new $2.0 billion assembly plant in Aguascalientes, Mexico. This investment added capacity to produce 175,000 light vehicles (Sentra) annually for the United States, Mexico, and Latin America, with plans to expand. This project planned to create or retain 3,000 jobs.

- In 2017, Toyota and Mazda announced a joint venture to build a new $1.6 billion assembly plant in Huntsville, Alabama. Each automaker is planning to produce a new CUV model[1] at this plant. This investment is expected to create or retain 4,000 jobs.

- Earlier this year, FCA announced it would invest $1.6 billion to convert its engine plant in Detroit, Michigan, into an assembly plant for the next-generation Jeep Cherokee and a new Jeep SUV. This announcement is expected to create or retain 3,850 jobs.

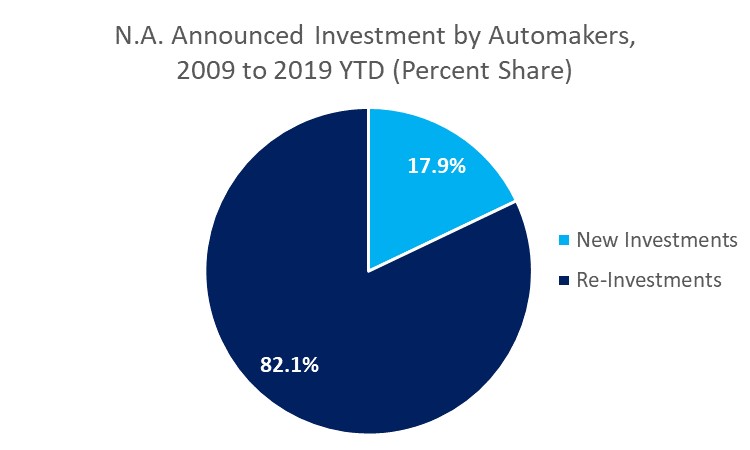

While these new facility investments tend to garner attention throughout state economic development organizations, government officials, and the general public, these big prizes make up less than 20 percent of all North American automotive investments. Figure 1 below shows that more than 80 percent of automaker announcements across North American since the recession have been re-investments into facilities. Re-investments include expansions to offices or plants as well as retooling of manufacturing facilities for a next-generation vehicle or new product.

Figure 1: N.A. Announced Investment by Automakers, 2009 to 2019 Oct. YTD

Source: CAR’s Book of Deals, October 2019

In 2019…

So far this year, automakers have announced 62 investment projects totaling more than $17.0 billion across North America. These investments are projected to create or retain nearly 36,000 jobs. The most significant automaker announcement made this year was GM’s October plans to invest a total of $7.7 billion across several plants in the United States throughout the next four years. These investments were made public in conjunction with the company’s new labor agreement between GM and the UAW, and includes GM’s plans to invest $3 billion into its plant in Hamtramck, Michigan—the most significant single investment announcement made this year. The GM-Hamtramck investment is to retool the assembly plant to build electric pickups, vans, and battery modules and is projected to create or retain nearly 2,500 jobs.

[1] Note – In the original announcement, Toyota planned on producing the Corolla at this facility; this is no longer Toyota’s planned product for this plant.

Members of CAR’s ACP program receive monthly Book of Deals automotive investment updates. For more information about the Book of Deals or the ACP program, please contact Terni Fiorelli at tfiorelli@cargroup.org.

OEDA Congratulates Graduates of the 2025 Ohio Basic Economic Development Course

OEDA Congratulates Graduates of the 2025 Ohio Basic Economic Development Course DUBLIN, OH – The Ohio Economic Development Association (OEDA) proudly congratulates the more than 85 participants who successfully completed the 2025 Ohio Basic Economic Development Course...

OEDA Begins Strategic Planning Amid Record Growth + Program Expansion

FOR IMMEDIATE RELEASE RFP now open for OEDA’s next strategic plan; proposals due July 1, 2025 COLUMBUS, OH; Tuesday, June 3, 2025 — The Ohio Economic Development Association (OEDA) has released a Request for Proposals (RFP) to develop a new strategic plan, its first...

OEDA seeks host communities for its Annual Summit

For Immediate Release OEDA seeks host communities for its Annual Summit For the first time, location proposals sought for 400+ attendee conference COLUMBUS, OHIO – TUESDAY, NOVEMBER 12 – Today, the Ohio Economic Development Association (OEDA) announced that is...