SBA Prime Source of COVID 19 Survival Financing During Second Wave

David J. Robinson

The Montrose Group, LLC

A second wave of COVID 19 may force millions of American businesses to seek local, state, and federal government subsidized short term financing to survive an economy pushed into recession by a series of state public health decisions. The passage of the federal Stimulus legislation has substantial changes to the U.S. Small Business Administration which should make this organization a prime stop for companies, sole proprietors, independent contractors, self-employed, tribal business, 501 (c)(3), or a 501 (c)(19) veterans organization with less than 500 employees (full time, part time or other status) seeking financing.

SBA Federal Stimulus Loan Program Summaries

| SBA Stimulus Loan Program | Loan Description |

| Economic Injury Disaster Loans | $2M loan in working capital with no personal guarantee & $10,000 emergency grants |

| Paycheck Protection Program | $10M forgivable loan for payroll and select working capital |

| 7(a) and 504 Loans | SBA pays principal and interest for six months |

Gaining small business financing tied to COVID 19 involves first understanding what new regulatory and funding changes the federal Stimulus legislation provided. Small business owners in all U.S. states, Washington D.C., and territories were able to apply for an Economic Injury Disaster Loan a forgivable advance of up to $10,000. Recipients do not have to be approved for a loan to receive the advance, but the amount of the loan advance will be deducted from total loan eligibility. The federal stimulus program also created the Paycheck Protection Program (PPP). PPPs are temporary changes to the SBA 7(a) loan program by creating a new subset of 7(a) loans called Paycheck Protection Program loans. This program provides lenders 100% loan guarantees for loans of up to $10 M per small business for payroll losses and select working capital cost, and the. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. The loan will be fully forgiven if the funds are used for payroll costs, interest on mortgages, rent, and utilities (due to likely high subscription, at least 75% of the forgiven amount must have been used for payroll). Loan payments will also be deferred for six months. No collateral or personal guarantees are required. Neither the government nor lenders will charge small businesses any fees. This loan has a maturity of 2 years and an interest rate of 1%. Forgiveness is based on the employer maintaining or quickly rehiring employees and maintaining salary levels. Forgiveness will be reduced if full-time headcount declines, or if salaries and wages decrease.

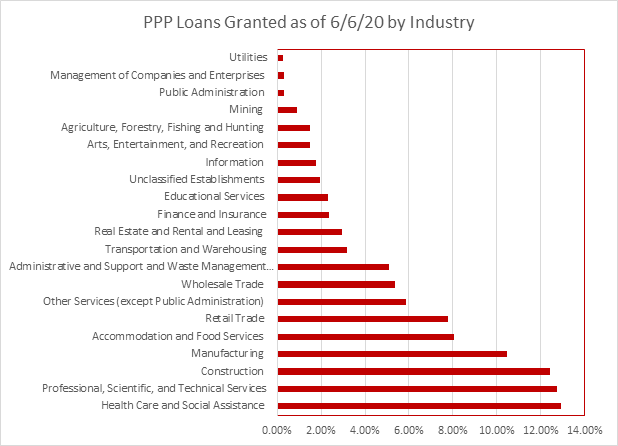

The overall current average PPP loan size is at $113,000 with over 21% of the PPP loans between $350,000-$1,000,000 according to a June 6, 2020 Treasury Department report. The chart above illustrates the industries leading in the collection of PPP loans again as of June 6, 2020.

Federal stimulus SBA funding is still available for eligible entities and please contact Dave Robinson at drobinson@montrosegroupllc.com if you need financial assistance.

OEDA Congratulates Graduates of the 2025 Ohio Basic Economic Development Course

OEDA Congratulates Graduates of the 2025 Ohio Basic Economic Development Course DUBLIN, OH – The Ohio Economic Development Association (OEDA) proudly congratulates the more than 85 participants who successfully completed the 2025 Ohio Basic Economic Development Course...

OEDA Begins Strategic Planning Amid Record Growth + Program Expansion

FOR IMMEDIATE RELEASE RFP now open for OEDA’s next strategic plan; proposals due July 1, 2025 COLUMBUS, OH; Tuesday, June 3, 2025 — The Ohio Economic Development Association (OEDA) has released a Request for Proposals (RFP) to develop a new strategic plan, its first...

OEDA seeks host communities for its Annual Summit

For Immediate Release OEDA seeks host communities for its Annual Summit For the first time, location proposals sought for 400+ attendee conference COLUMBUS, OHIO – TUESDAY, NOVEMBER 12 – Today, the Ohio Economic Development Association (OEDA) announced that is...