The Answers to Four Questions Determine if Your Region Behind in the Opportunity Zone Battle

Nate Green

Montrose Development Advisors

Maybe it is a silly question since the ink on the IRS regulations are not dry nor are the even written in ink but economic development, elected officials and real estate developers are asking the question—is our region already behind in attracting capital for Opportunity Zones? The answer to four questions determines if your region is behind in this critical economic development opportunity.

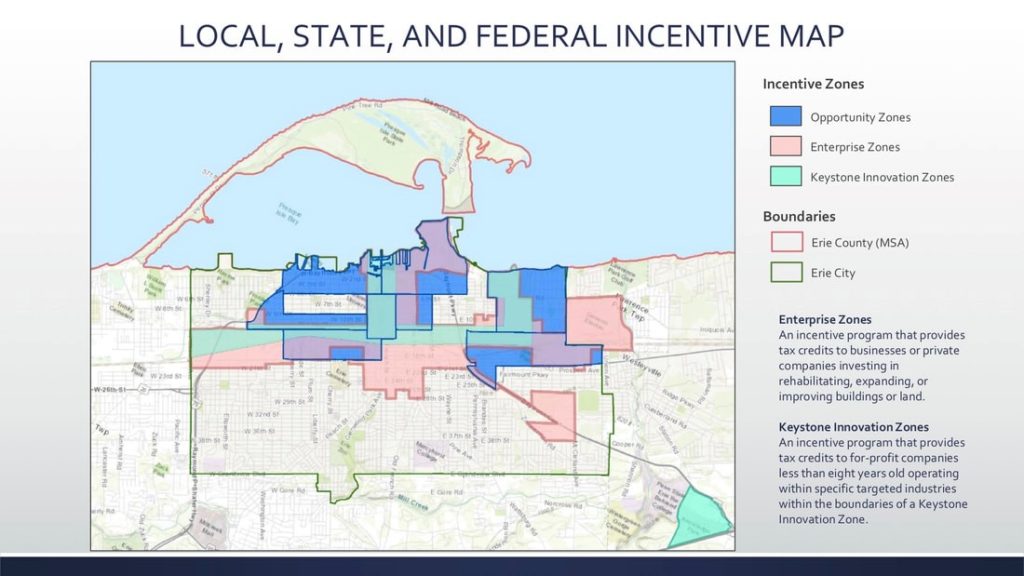

Are your Opportunity Zone sites ready for development? Opportunity Zones are on the Treasury list for a reason— they are complex sites that need a government subsidy to succeed. The first question that needs an affirmative answer is whether these census tracts have a site development plan, entitlements and incentives in place that make them an attractive investment opportunity. Erie, Pennsylvania offers an early success story for a community that has its act together related to their Opportunity Zones.

Even before the Opportunity Zone regulations were announced the The PA Flagship Opportunity Zone Corporation was developed to identify deal flow, identify local funds, connect with developers and investable business opportunities; work with economic development organizations and professionals, and connect local investors, lenders, bankers, and service providers. The PA Flagship Opportunity Zone has created an indepth prospectus for potential investors that illustrates clear site plans needed for economic success which can be found at http://www.erie.pa.us/Portals/0/Content/News/City%20of%20Erie%20Investment%20Prospectus.pdf

Is your state organizing and educating Opportunity Zone owners? State leadership in the Opportunity Zone issue is critical. Regions don’t often play well together and the reality is regions working together offer a better package to investors than on their own. In addition, state governments can pass tax policy and create new economic development incentives that can spur growth in Opportunity Zones. In the early stages of Opportunity Zones, state leadership involves organizing and educating local Opportunity Zone owners about what they should be doing but also promoting their sites with investors. The Illinois Department of Commerce and Economic Opportunity is convening forums to educate communities about Opportunity Zones and introduce them to potential investors and Opportunity Fund managers and is considering the potential creation of a state-operated Opportunity Fund with other branches of the Illinois state government. The Kentucky Cabinet for Economic Development dedicated a portion of its website to act as a clearinghouse for all information related to Opportunity Zones in Kentucky including a map of available industrial sites and buildings located in Opportunity Zones, and is planning a regional tour to provide communities with information and resources to capitalize on their Opportunity Zones.

Is your state organizing and educating Opportunity Zone owners? State leadership in the Opportunity Zone issue is critical. Regions don’t often play well together and the reality is regions working together offer a better package to investors than on their own. In addition, state governments can pass tax policy and create new economic development incentives that can spur growth in Opportunity Zones. In the early stages of Opportunity Zones, state leadership involves organizing and educating local Opportunity Zone owners about what they should be doing but also promoting their sites with investors. The Illinois Department of Commerce and Economic Opportunity is convening forums to educate communities about Opportunity Zones and introduce them to potential investors and Opportunity Fund managers and is considering the potential creation of a state-operated Opportunity Fund with other branches of the Illinois state government. The Kentucky Cabinet for Economic Development dedicated a portion of its website to act as a clearinghouse for all information related to Opportunity Zones in Kentucky including a map of available industrial sites and buildings located in Opportunity Zones, and is planning a regional tour to provide communities with information and resources to capitalize on their Opportunity Zones.

Do you have an Opportunity Fund Prospectus? Capturing the early investors in Opportunity Zones involves work. Long-term, larger players like the investment banks and insurance companies are likely to wait for the dust to settles on the IRS regulations and the program. However, high-wealth individuals, venture capitalists and others enjoying substantial capital gains have a looming tax bill waiting and are searching for Opportunity Zone Fund investments. Making an Opportunity Zone investment involves creating your own Opportunity Zone Fund or investing in one of the early Opportunity Zone funds. The best chance for regions to capture this early Opportunity Zone money is to organize their existing Opportunity Zones into a prospectus that provides detailed information on the area’s Opportunity Zones. Louisville, Kentucky offers an example of a high-quality Opportunity Zone prospectus– https://louisvilleky.gov/sites/default/files/louisville_forward/louisville_prospectus_11.13.2018.pdf.

Do you have a regional Opportunity Zone Fund? One site Opportunity Funds are being created all over the United States primarily targeted toward multi-family and other real estate developments for individual property owners. Workforce housing is of critical importance in communities across the United States and these small funds matter. However, it is doubtful these individual funds will be transformational for a region or state. Instead, communities across the United States, often through private sector players, are launching regional Opportunity Funds. The Detroit Opportunity Fund offers just one example. North Coast Partners, a Detroit real estate investment company, announced in June of 2018 the launch of the Detroit Opportunity Fund, which will invest in newly designated opportunity zones in the Detroit Area. The fund is reportedly beginning with a $500-million pipeline of new deals in the city. The fund is noteworthy because it is reportedly the first of several geographically-targeted opportunity funds that will be offered by North Coast Partners through North Coast Asset Management.

OEDA Congratulates Graduates of the 2025 Ohio Basic Economic Development Course

OEDA Congratulates Graduates of the 2025 Ohio Basic Economic Development Course DUBLIN, OH – The Ohio Economic Development Association (OEDA) proudly congratulates the more than 85 participants who successfully completed the 2025 Ohio Basic Economic Development Course...

OEDA Begins Strategic Planning Amid Record Growth + Program Expansion

FOR IMMEDIATE RELEASE RFP now open for OEDA’s next strategic plan; proposals due July 1, 2025 COLUMBUS, OH; Tuesday, June 3, 2025 — The Ohio Economic Development Association (OEDA) has released a Request for Proposals (RFP) to develop a new strategic plan, its first...

OEDA seeks host communities for its Annual Summit

For Immediate Release OEDA seeks host communities for its Annual Summit For the first time, location proposals sought for 400+ attendee conference COLUMBUS, OHIO – TUESDAY, NOVEMBER 12 – Today, the Ohio Economic Development Association (OEDA) announced that is...