COVID-19 changed the future of retail real estate development by advancing our retail shopping habits five years.

Pete DiSalvo

DiSalvo Development Advisors, LLC (DDA)

Remember your last New Year’s resolution? Chances are it failed within the first month. New habits have a better chance of taking hold after at least two months (source: How are habits formed: Modelling habit formation in the real world, Phillippa Lally, et al.). Store closures and curbside pickups during COVID extended for nearly three months in most markets and forced many to make changes in their shopping behaviors, creating a surge in online shopping.

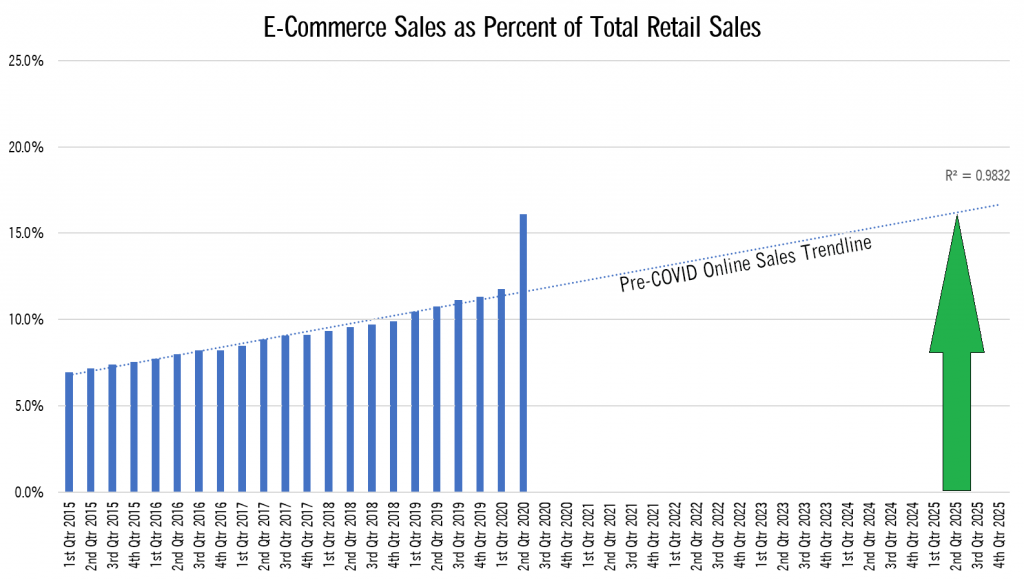

In 2020’s Second Quarter, the US Department of Commerce reported e-commerce or online retail sales reached an all-time high of $1 of every $6 spent on retail was online (16.1%), an increase in the share of retail sales from the prior year of 5.3 percentage points. The highest previous increase in the share of online spending in the past decade was 0.6 percentage point in the First Quarter 2019. Based on a trend analysis of quarterly shares of online retail sales since 2010, the nation was on pace to reach a 16% online retail spending share by 2025. While the closure of retailers created an explosion of increased online spending, now that consumers have experienced this mode of shopping, a new baseline for future spending trends can be expected.

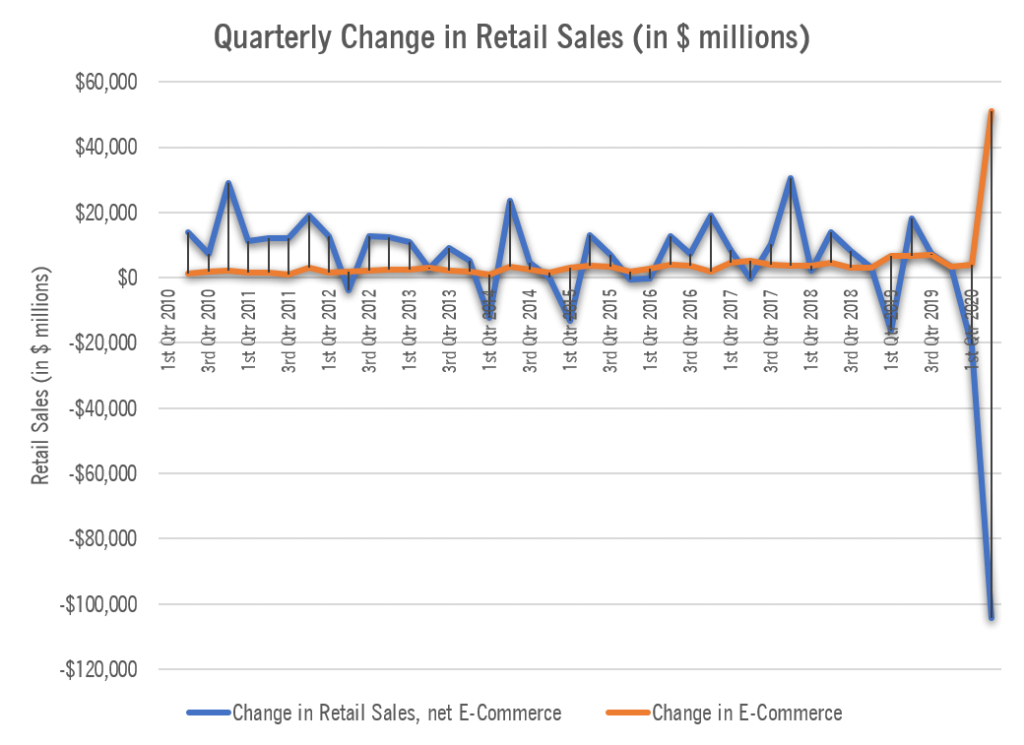

What does the increased share of online shopping mean to current and future retail real estate development? The jump in online retail sales over the last quarter nearly matched the increase in overall retail sales, indicating an immediate decline in demand for occupied retail space. Growth in retail spending no longer equates to new retail development as the online sales market share is increasing at a rate approaching the actual increase in total retail sales.

The retail real estate pie is shrinking. Now that shoppers are more familiar and comfortable with online shopping, communities and developers must give them a compelling reason to leave their homes to shop for retail goods. Future retail development has to be more thoughtful and experiential to survive in today’s retail environment. In large part, that means giving patrons more than just retail.

An opportunity exists in many of Ohio’s communities to be creative and think beyond the park-shop-and-go-home retail centers into more walkable mixed-use formats integrating non-retail and restaurant/food truck uses that give visitors an experience beyond shopping. The traditional big-box department store anchor, which is one of the hardest hit retail categories by online sales, can be replaced by other high-volume non-retail visitor venues, such as libraries, YMCAs and programmed outdoor spaces. COVID’s acceleration of the online retail market is a warning call to all developers to refocus development efforts to full-on customer experience.

OEDA Congratulates Graduates of the 2025 Ohio Basic Economic Development Course

OEDA Congratulates Graduates of the 2025 Ohio Basic Economic Development Course DUBLIN, OH – The Ohio Economic Development Association (OEDA) proudly congratulates the more than 85 participants who successfully completed the 2025 Ohio Basic Economic Development Course...

OEDA Begins Strategic Planning Amid Record Growth + Program Expansion

FOR IMMEDIATE RELEASE RFP now open for OEDA’s next strategic plan; proposals due July 1, 2025 COLUMBUS, OH; Tuesday, June 3, 2025 — The Ohio Economic Development Association (OEDA) has released a Request for Proposals (RFP) to develop a new strategic plan, its first...

OEDA seeks host communities for its Annual Summit

For Immediate Release OEDA seeks host communities for its Annual Summit For the first time, location proposals sought for 400+ attendee conference COLUMBUS, OHIO – TUESDAY, NOVEMBER 12 – Today, the Ohio Economic Development Association (OEDA) announced that is...